Mortgage lead automation is an important tool for mortgage lenders and real estate agents to use in order to increase their leads. Automation can help lenders get more qualified leads and reduce the time it takes to evaluate them. Automation can also help identify those leads that are most likely to become customers.

In this post, we'll discuss three benefits of automating mortgage lead generation in your real estate business, and the best means of doing it. But first, let's explore what mortgage lead automation is.

What is Mortgage Lead Automation?

Mortgage lead automation is the process of using technology to streamline the way mortgage leads are captured, qualified, and passed along to loan officers. Automation can help your team manage their time more efficiently and improve the accuracy of their work.

One common type of mortgage lead automation is the use of a web form on your website. When a visitor completes the form, their information is automatically added to a database and routed to the appropriate person for follow-up. This saves time by eliminating the need to manually enter data into a system or sort through piles of paper leads.

Another popular automation tool is email marketing software. This can be used to send automated messages to potential leads, inviting them to learn more about your products or services.

What are the Benefits of Mortgage Lead Automation?

The top three benefits of mortgage automation in terms of gathering leads are:

- Faster first-contact to the leads (speed to lead)

- Smooth nurturing of mortgage leads

- Makes your mortgage business scalable

Now that you know the three benefits of mortgage lead automation, let's break them down further so you can propel your business forward at lightning speed.

1. Faster first-contact

Mortgage lead automation can speed up the process of reaching out to potential leads. By automating the process, you can eliminate the need for human interaction, which can speed up the process of getting in touch with potential leads. This can be especially helpful if you are working with a large number of leads. Additionally, it can help to ensure that all leads are contacted in a timely manner.

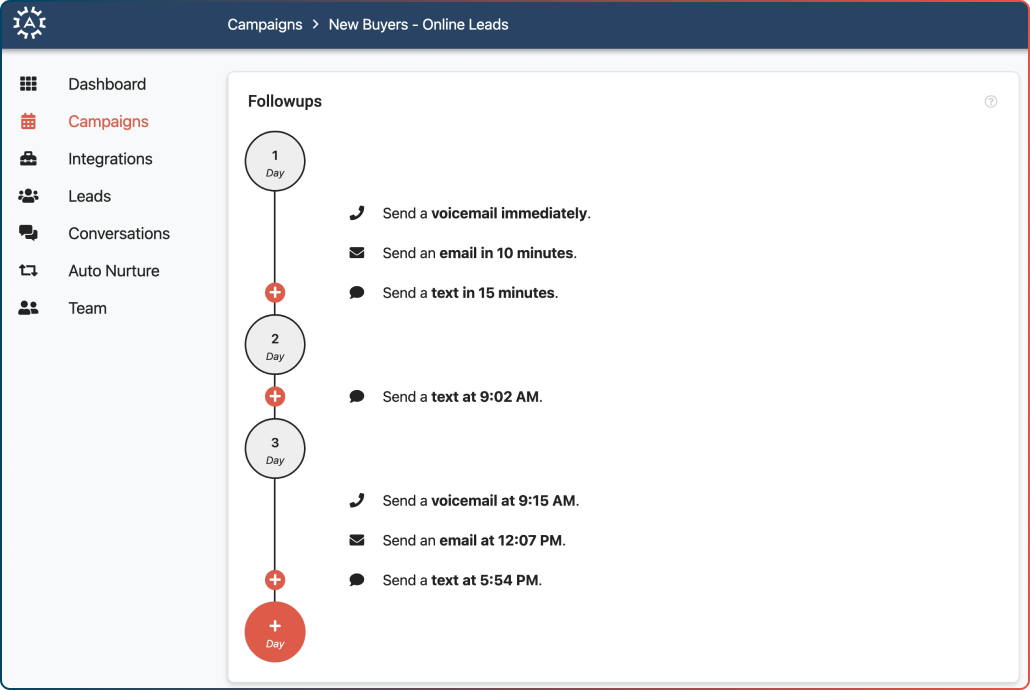

If you're using the right software for your mortgage lead automation, you'll still enjoy that personalized touch, however. In fact, with a program like Agent Legend, you can even automate your mortgage lead nurturing.

2. Smooth nurturing of mortgage leads

Mortgage lead nurturing can be automated through the use of marketing automation software. By automating the process, you can ensure that leads are consistently contacted and provided with the information they need to make a purchase decision.

The key to successful mortgage lead nurturing is to provide potential buyers with the information they need in a timely manner. This means contacting them as soon as possible after they express an interest in purchasing a home. It also means providing them with regular updates on the progress of their loan application.

Through automated lead nurturing, you can ensure that your leads receive the attention they deserve and that you maintain a consistent flow of new business.

3. Makes your mortgage business scalable

Mortgage lead automation helps your mortgage business grow in scale. It does this by taking care of some of the more mundane and time-consuming tasks that are associated with the mortgage business. This leaves you with more time to focus on acquiring new customers and servicing the ones you already have.

One of the key benefits of mortgage lead automation is that it allows you to process more leads in a shorter amount of time. This is because the software streamlines many of the tasks that are traditionally done manually. This includes things like data entry, lead routing, and task assignment.

One of the key benefits of mortgage lead automation is that it allows you to process more leads in a shorter amount of time. This is because the software streamlines many of the tasks that are traditionally done manually. This includes things like data entry, lead routing, and task assignment.

Another benefit of using mortgage lead automation software is that it can help you stay organized. By automating many of the tasks associated with mortgages, you can create a system that is easy to follow and makes it simpler to find information when you need it.

Agent Legend Makes It Easy

Mortgage lead automation can include anything from automatically adding new leads to your CRM, to automatically sending out follow-up emails, or even setting up a system where new leads are automatically routed to the right agent.

The benefits of mortgage lead automation are clear. By automating as much of your process as possible, you can save yourself time and energy, and focus on closing more loans.

But where should all these leads that you're gathering go? And, how can you nurture them effortlessly without losing the personal touch your clients are depending on? That's where Agent Legend comes in. With our software, we make it easy for you to automate your mortgage lead process, from start to finish. You can focus your energy on creating all the ads and lead magnets once, and as they roll in, Agent Legend can help you sort, score, and manage your contacts with ease. Get a free trial and see what we can do for your real estate business!