When you get a mortgage lead, it's important to have a process in place to manage it. This will help ensure that you don't miss any opportunities and that you can follow up with the potential customer in a timely manner. Your process should start with immediately capturing the lead's information, but then where do you go from there? In this guide, we'll share how to optimize the mortgage lead management process, and give you some insights for successfully closing more sales along the way. Let's get started!

What is Mortgage Lead Management?

Mortgage lead management is the process of managing the pipeline of potential mortgage customers. A mortgage lead is any customer that has filled out an application and been put on a list for further consideration.

Mortgage lead management is designed to improve the customer experience, increase loan production, and reduce customer churn. By managing the sales and service of their mortgages, mortgage lenders can achieve these goals while improving their bottom line.

How to Optimize the Mortgage Lead Management process?

There are three basic steps to optimizing the mortgage lead management process. They are:

- Create the right content for mortgage lead generation

- Manage the lead funnel, and

- Choose a good mortgage lead management software to streamline the process from beginning to end

Now that you know the three basic steps, let's break them down further to help you make quick work of your mortgage leads and thereby boost your business.

1. Create the right content for mortgage lead generation

Creating the right content for mortgage lead generation online can be a challenge. However, if you follow a plan, it can be easier. Step one for your content plan is to identify your target audience. Once you know who you are writing for, you can create content that is relevant and interesting to them.

Ask yourself:

- What does my potential lead want to know? i.e. What questions do they have about mortgages?

- What are they struggling with?

- What problems are they having that my content could solve related to getting a mortgage?

The next step for your content plan should be to develop a content strategy. This will help you plan out your content and make sure it is consistent and effective. You should also consider where you will be sharing it and what keywords you'll include in your content to help with SEO.

Consider things like:

- How will you create this content? i.e. Will you hire out the writing of the content or add time to your schedule to create it yourself?

- Will you need custom graphics?

- How often can you share on social media? (and what tools will help to schedule these posts?)

Finally, make sure you are regularly publishing new content. This will keep your website and social media pages fresh which in turn will help you to attract new leads.

2. Manage the lead funnel

What does managing the lead funnel look like in the mortgage lead management process?

It begins with managing contact details. Once you have the lead's information, you'll need to determine whether or not they're a good fit for your company. Some factors you may consider include their credit score, loan amount, and location. You'll also want to make sure that you have the ability to approve or deny the loan within a certain time-frame.

Next, you want to send regular status updates. This is akin to nurturing the lead. It's important to keep the lead informed of whether or not they will qualify for a mortgage. If not, this could mean sending them information on how to get approved and steps they can take to improve their standing.

Finally, manage the acquisition process. If they do qualify for a mortgage, what's the next step? Give your lead the tools they need and the answers to their questions of where to go from pre-qualification to qualification to actually closing on their property.

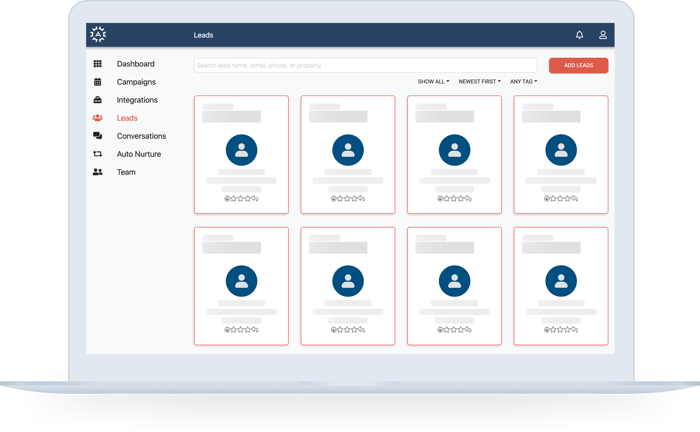

3. Choose a good mortgage lead management software

There are lots of choices for mortgage lead management software on the market, but they are not all created equal. At the risk of sounding incredibly self-serving, we recommend Agent Legend. More than 10,000 loan officers and real estate agents choose our software to streamline the process of managing their mortgage and real estate leads.

With software you can score and prioritize your leads, set up nurture sequences that run on autopilot, and keep your company top of mind every step of the way to close more deals and increase your bottom line. Anyone working in a service based business will tell you that the personalized touch is critical to success, but that doesn't mean you have to spend every waking moment personally reaching out to everyone on your lead list. Agent Legend helps you deliver that personal touch that your leads crave with little effort.

With software you can score and prioritize your leads, set up nurture sequences that run on autopilot, and keep your company top of mind every step of the way to close more deals and increase your bottom line. Anyone working in a service based business will tell you that the personalized touch is critical to success, but that doesn't mean you have to spend every waking moment personally reaching out to everyone on your lead list. Agent Legend helps you deliver that personal touch that your leads crave with little effort.

Imagine creating a text message sequence or string of emails that are dripped out over time to your leads so they get the information they need when they need it without having to repeat the process yourself over and over again. Do the work once, and have our software repeat your correspondence for you.

Learn all that Agent Legend can do for you. Get started for free today, and take your mortgage lead management process to the next level!